Aramco’s head honcho, Amin Nasser, is all in on China for bringing down the price tag on solar panels and electric vehicles. While the West is pointing fingers at China for flooding the market with super cheap green tech, Saudi Arabia is all about getting cozy with China, trying to get a piece of the action with investments and sweet business deals.

China’s green scene has found an unlikely cheerleader in Saudi Aramco, the oil behemoth. They’re tipping their hats to the globe’s second-biggest economy for making solar and electric rides easier on the wallet.

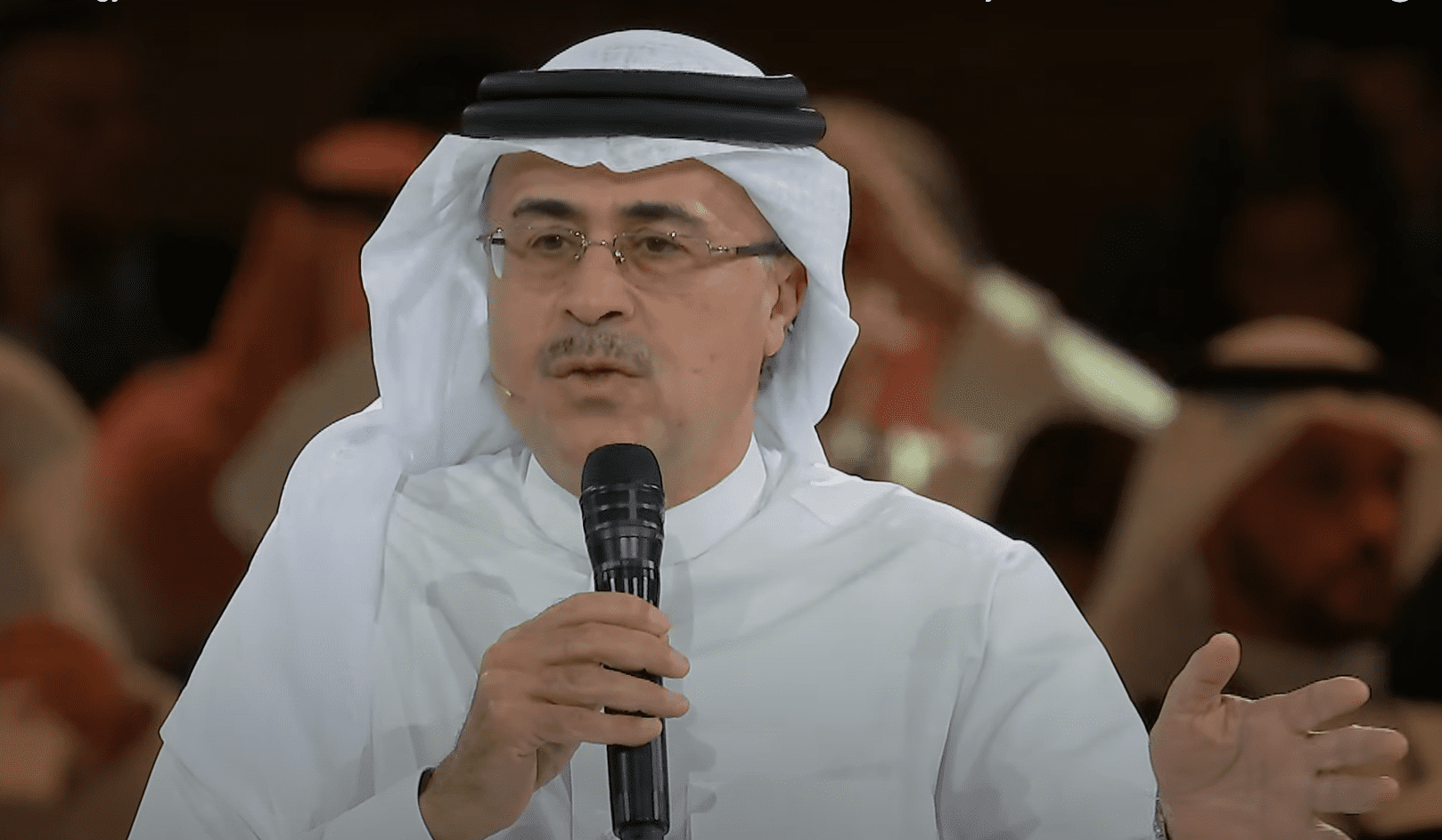

“China really stepped up by making solar energy cheaper,” said Aramco CEO Amin Nasser at the World Energy Congress in Rotterdam this Monday, as per the Financial Times.

And it’s not just solar. “Electric vehicles? Same story. They’re like a third to half the price of what others are charging,” Nasser continued, pushing the need for more global teamwork, as reported by the FT.

Thanks to China’s budget-friendly green products, Nasser believes they’re the ticket to help the West slash their carbon footprint down to nothing by 2050.

But not everyone’s throwing a party over this. The West has been vocal about their beef with China’s tactics of dropping super cheap solar panels and EVs in everyone’s lap.

This month, U.S. Treasury Secretary Janet Yellen called out China for pumping out too much stuff during her trip there.

“China’s got to cool it with the mass production because the world can’t keep up,” Yellen cautioned. She reminded everyone of the time China went wild with steel, which wasn’t exactly a hit for global industries.

Last week, Germany’s big boss, Chancellor Olaf Scholz, chimed in with similar vibes during his China visit, pressing for fair play in the market.

Meanwhile, Beijing clapped back at these dumping accusations, framing them as a ploy to stunt China’s economic glow-up.

In the midst of this, Saudi Arabia is threading tighter ties with China. Riyadh isn’t playing by the West’s rules but is instead snuggling closer to Beijing.

Back in January, Saudi’s economy and planning minister, Faisal Alibrahim, spilled to the Nikkei that beefing up ties with China was a smart move. “There’s a ton of room for China to dive into investments here,” Alibrahim shared. And it’s not all take; Saudi’s also eyeing investment chances in China.

Saudi’s big push is to lure Chinese dough into its Neom megacity dream, a shiny project on the Red Sea set to pivot the kingdom’s economy from oil to tech and tourism hotspots.

With the West itching to ditch fossil fuels, Aramco’s got every reason to buddy up with China. Just this Monday, they even hinted at grabbing a 10% stake in China’s Hengli Petrochemicals, marking yet another link in a chain of deals with Chinese refineries over the past year.

Last March, China even played peacemaker between Saudi Arabia and Iran, making some wonder about the U.S.’s slipping grip in the Middle East.

Despite these blossoming ties, the Chinese presence in Saudi isn’t all that heavy yet. Jon Alterman from the Center for Strategic and International Studies laid it out in a U.S. hearing last Friday: “Saudi knows it needs a strong bond with China,” he said. “Even if China doesn’t edge out the U.S., it’s a critical balance against what the U.S. offers.”

Leave a Reply