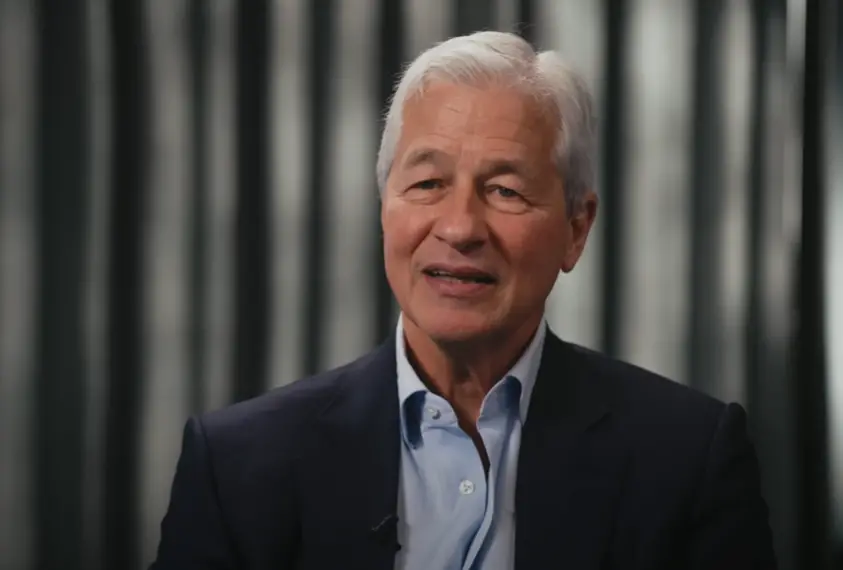

Jamie Dimon, the big boss at JPMorgan, recently spilled some thoughts on how American consumers are sitting pretty financially right now, but he also threw in a few warnings about tough times that might be coming up. He touched on the sticky issue of high prices sticking around (that’s inflation for you), possible hikes in interest rates, and even the scary thought of a recession looming over us. He also pointed out that despite all the buzz around cryptocurrencies like Bitcoin, they haven’t really shaken things up in the financial world.

While chatting at the Economic Club of New York this Tuesday, Dimon pointed out that most folks are doing okay with their money. Home values and the stock market have been on the up, which is good news for everyone’s wallet. Plus, people aren’t drowning in debt payments like before, which is another plus.

But even with the economy looking strong and jobs being pretty stable, Dimon warned that we’re not out of the woods. He mentioned in a clip from Bloomberg, “Even if we go into a recession, the consumer’s in good shape. That doesn’t mean you can fight off the effects of stagflation or anything like that if it gets much worse.”

He’s still a bit jittery because, even though inflation has cooled down from its crazy high last summer to under 4% now, it’s still not hitting that sweet spot of 2% that the Fed wants. The Fed has been bumping up interest rates to try and keep inflation under control, which is supposed to cool down spending and investment. This move is meant to help, but it could also slow things down so much that we might stumble into a recession.

On X, Dimon pointed out that if interest rates keep climbing, it could really hit a lot of areas hard—like businesses that owe a lot, jobs, profits, and even the housing market.

He also shared some worries about how messy the world is right now, saying it’s probably the most tangled and risky since World War II because of things like U.S.-China tensions and ongoing issues in places like Ukraine and the Middle East. These problems could mess with oil and gas prices, throw a wrench in trade, and stress out military relationships, which hits poorer countries especially hard.

And about cryptocurrencies, Dimon didn’t hold back. He admitted blockchain technology is the real deal and they’re using it, but overall, the big crypto revolution just hasn’t taken off despite all the hype.

In a nutshell, Jamie Dimon thinks American consumers are doing alright for now, but he’s keeping an eye on some big potential headaches both here and globally.

Leave a Reply